News

Latest news & updates

November

28

Check our news

April

23

November

7

Our Facebook

November

28

November

7

View all our news items

Our brands

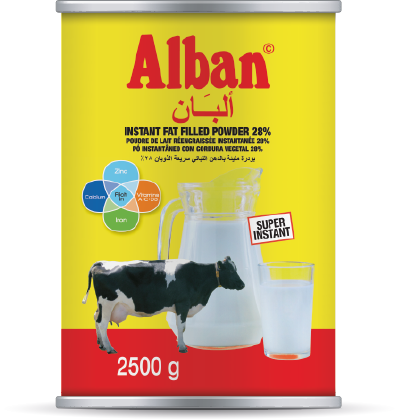

Our first brand: Alban

Alban is one of our most well-known brands. We offer different types of Alban milk powder, such as full cream milk powder and fat filled powder.

You are able to choose your own kind of packaging, either tins, sachets or bags. Please check our brand page for additional information.